Essential Guide for First-Time Renters

Renting is becoming increasingly popular.

Projections suggest that by 2039, the number of tenants in the UK will surpass homeowners.

However, the journey to renting a property can seem overwhelming.

There are many factors to consider and be aware of. This guide aims to simplify the process, providing you with all the necessary information to navigate your first rental experience successfully...

1. Review Your Finances

Before diving into the rental market, it’s essential to ensure your finances are in order. Here’s how to prepare:

Assess Your Financial Situation: Start by evaluating your income and expenses. Ensure that the remaining amount after your regular outgoings is enough to cover the rent and other associated costs.

Check Your Credit Score: Use a service like Experian to review your credit score. If it's lower than expected, consider taking steps to improve it before you start your rental search.

Consider a Guarantor: If your financial history might be a concern, think about having a guarantor. A guarantor, often a family member, agrees to cover the rent if you’re unable to make payments.

Prepare for Guarantor Requirements: Be ready for the possibility that a landlord or agent might request a guarantor. Identify someone who might be willing to support your application in advance.

How Much Rent Can You Afford?

Experts recommend spending no more than 30%-35% of your gross annual income on rent. To calculate your affordable rent:

Calculate Your Annual Income: Determine your total salary before taxes.

Find 30% of Your Income: Multiply your annual salary by 30%.

Determine Monthly Rent: Divide this figure by 12 to find your maximum monthly rent. For instance, with a £30,000 annual salary, 30% amounts to £9,000, translating to a maximum of £750 per month.

What About the Deposit?

For renting a property, you’ll need to provide a deposit:

Deposit Amount: If the annual rent is £50,000 or less, the deposit should be equivalent to five weeks’ rent. For rents above £50,000, it should be six weeks’ rent.

Example: For a property with a £750 monthly rent, the annual rent totals £9,000. The weekly rent would be £173, requiring a deposit of £865.

Deposit Protection: Your landlord must place your deposit in a government-approved scheme within 30 days of your tenancy starting.

What Does PCM Mean?

PCM stands for 'per calendar month', meaning that your rent is collected monthly on the same day each month, resulting in 12 payments per year.

2. Finding the Right Property

Once you've reviewed your finances and decided to rent, it's time to start your property search. The location and type of property you choose can significantly impact the rent you’ll pay. Here’s how to approach it:

Determine Your Needs and Preferences:

Affordability: Know what you can comfortably spend on rent each month.

Property Size: Decide on the size of the property you need.

Location: Choose your ideal area, considering proximity to family, friends, or work.

Lifestyle: Decide if you prefer a bustling city environment or a quieter area.

Start Your Search:

Online Listings: Look for properties online that fit your budget and needs. Make a list of potential options.

Local Letting Agents: Contact local letting agents to help with your search. A reputable agent can simplify the renting process.

What to Look for in a Letting Agent:

Accreditation: Ensure they are members of property redress schemes like the Property Ombudsman or the Property Redress Scheme.

Professional Membership: Look for memberships in trade bodies such as ARLA, RICS, or NAEA.

Reputation: Check for positive online reviews and a professional online presence.

Transparency: They should communicate clearly about costs and processes.

Viewing Rental Properties

Property viewings are an exciting part of the rental process. Here’s how to make the most of your viewings:

Exterior Inspection: Check the property’s exterior for maintenance issues like damaged brickwork or poor window condition.

Room Measurements: Measure rooms to ensure they meet your size requirements.

Test Fixtures: Turn on lights, taps, and open cupboards to ensure everything is functioning properly.

Check Security: Evaluate the quality of locks on windows and doors, and see if there’s an alarm system.

Mobile Signal: Test your phone’s reception in different rooms.

Noise Levels: Assess both external and internal noise levels, including traffic and neighboring properties.

Storage: Ensure there’s sufficient storage space for your belongings.

Revisit the Property: If you’re interested, visit again at a different time of day to check for any issues you might have missed.

Ask Questions: Make sure to ask the letting agent or landlord any questions you have about the property and tenancy terms.

Furnished vs. Unfurnished

Rental properties are typically listed as furnished or unfurnished. Here’s what you need to know:

Furnished Properties: These usually include: Essential items like beds, wardrobes, and sofas White goods (large appliances such as fridges, washing machines, and ovens) Renting furnished can save you the cost of buying these items, especially if you don’t yet own furniture.

Unfurnished Properties: These offer more flexibility if you want to bring your own furniture, making the space feel more personalized.

Part-Furnished: This may include some furniture and essential items, but usually only basic white goods.

Avoiding Property Scams

Be cautious of potential scams in the rental market:

Scams to Watch For:

Fake Listings: Scammers may create listings for non-existent properties and ask for deposits before viewings.

Impersonation: Some may pretend to be agents or landlords, showing fake properties and asking for cash deposits.

Tips to Avoid Scams:

Use Registered Agents: Stick to registered agents listed on major online property portals.

Avoid Upfront Payments: Never pay money before viewing the property and verifying the legitimacy of the landlord or agent.

Next Steps After Viewing

If you find a property you like, you may be asked to pay a holding deposit:

Holding Deposit: This is capped at one week’s rent and should be refunded or applied to your rent if your application is successful.

Possible Retention: The landlord may keep your deposit if you:

Decide not to proceed with the tenancy

Provide false information

Fail right-to-rent checks

3. Meeting Rental Requirements

When renting a house or flat, you need to demonstrate that you can afford the rent and provide various documents to support your application. Your letting agent will also perform several checks to determine your suitability for the property.

Required Documentation

To assess your eligibility, you’ll need to provide:

References: From your current or previous landlord and employer.

Proof of Income: Recent payslips or, if self-employed, your tax returns or business accounts.

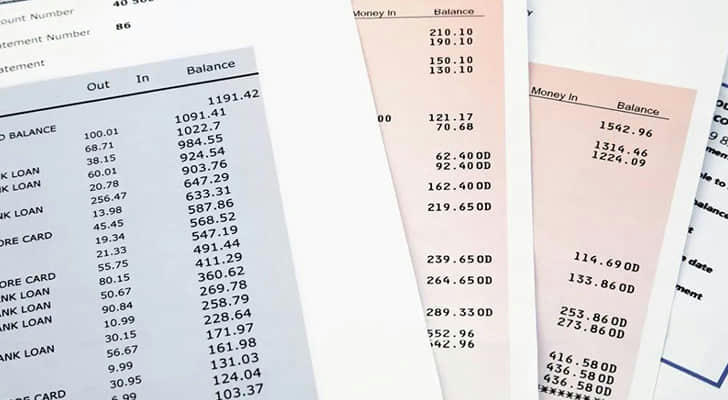

Bank Statements: Showing your regular outgoings.

Identity and Address Verification: Proof of who you are and where you live.

Right to Rent: Evidence that you have the legal right to rent in the UK.

Additionally, your letting agent will perform a ‘soft’ credit check, which includes:

Credit History: Details of any County Court Judgments (CCJs) or insolvencies.

Electoral Roll Status: Your registration on the electoral roll.

Credit Accounts: Any existing credit accounts associated with your name and address.

Right to Rent Check

Landlords are legally required to confirm that you have the right to rent in the UK. They can do this by reviewing specific documents or using an online checking service if you hold a biometric residence card, permit, or eVisa.

Renting Without Proof of Income

It can be challenging to secure a rental without proof of income. If you can’t provide this documentation, discuss alternatives with your letting agent, such as paying rent in advance or arranging for a guarantor.

Renting with Bad Credit

A poor credit history, including CCJs, can make it harder to secure a rental. If your credit report is a concern, your letting agent might require a guarantor to support your application.

Guarantor Requirements

A guarantor is someone who agrees to cover your rent if you are unable to pay. Typically, a guarantor is a close relative with a solid credit history and sufficient savings. Your letting agent will conduct a credit check on the guarantor and require proof of their income and savings.

Paying Deposit and First Month’s Rent

Once you pass the referencing and affordability checks and your application is accepted, you will need to pay your deposit and possibly the first month’s rent upfront. Landlords usually request the first month’s rent along with the deposit, but if you have poor credit or no guarantor, they may ask for additional funds.

4. Understanding Rental Bills

When you rent a property, there are several bills you’ll need to manage:

Council Tax: Local taxes for community services.

Energy Bills: Charges for gas and electricity.

Water and Sewerage: Costs for water supply and waste management.

Phone and Broadband: Expenses for telephone and internet services.

Service or Maintenance Charges: Fees for the upkeep of shared areas or facilities.

TV Licence: Legal fee for watching live TV or using BBC iPlayer.

Bills Included in Rent

Some rental properties offer a ‘bills included’ arrangement, commonly found in Houses in Multiple Occupation (HMOs) where tenants rent individual rooms and share common areas. If you're considering such a property, confirm with the letting agent exactly which bills are covered and if there are any additional costs you’ll be responsible for.

Home Insurance

While your landlord will have buildings insurance to cover the property structure, and likely contents insurance if the property is furnished, you may want to consider getting your own insurance if you have valuable personal belongings. This isn’t a requirement but can provide extra peace of mind.

TV Licence

If your rental agreement doesn’t specify that a TV licence is provided, you’ll need to obtain one if you plan to have a TV in the property.

Single Tenancy: One TV licence will cover the entire property. House in Multiple Occupation (HMO): Each tenant will need their own TV licence if renting separate rooms under individual agreements. This covers all TV usage in both private and communal areas.

5. Understanding Tenancy Rules and Regulations

When you rent a property, you must adhere to certain rules laid out in your tenancy agreement, which both you and your landlord will sign.

Signing a Tenancy Agreement

The tenancy agreement is a crucial document that outlines the terms of your rental. It’s essential to understand what you’re agreeing to before signing. Most tenancies are governed by an Assured Shorthold Tenancy (AST), and your agreement will typically include:

Start and End Date: The duration of your fixed-term tenancy.

Break Clause: Conditions under which either party can end the tenancy early.

Rent Amount: The monthly rent you need to pay.

Payment Date: When the rent is due each month.

Property Address: The location of the rental property.

Contact Information: Names and addresses of the landlord, letting agent, and yourself.

Deposit Details: The amount of your deposit and the protection scheme it’s under.

Tenant Responsibilities: Bills you are responsible for.

Pet and Smoking Policies: Rules regarding pets and smoking.

Maintenance Duties: Responsibilities for garden upkeep and property maintenance, including inspections.

Late Rent Payments

If you anticipate difficulty paying your rent on time, inform your landlord or letting agent immediately to discuss possible solutions.

Rent Increases

During a fixed-term tenancy (e.g., 12 or 24 months), your landlord can only increase the rent if you agree. At the end of the fixed term, any rent increase must be agreed upon during the renewal of the tenancy. For periodic tenancies (month-to-month or week-to-week), rent can only be increased once a year without your consent.

Decorating a Rented Property

Before making any changes or decorating the property, always seek your landlord’s permission. Your landlord might agree to alterations, but some agreements may prohibit any changes.

Renting with Pets

Renting with a pet is possible if your landlord consents. Always check the tenancy agreement for any pet-related restrictions.